2024 has been a year of recovery, nervousness and record production. Compared to the previous 12 months, the sheep and lamb market has shown strength and stability. However, when we look further back, unpredictability and volatility have continued to impact producers across the country.

Cautiousness

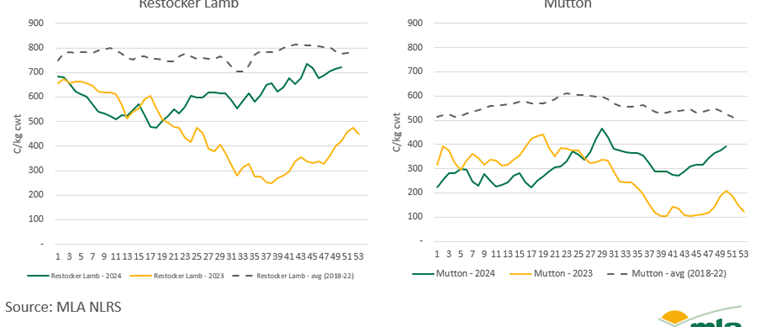

Coming out of an extremely volatile market, the sheep and lamb sector entered the new year in seeming recovery. Driven by a positive summer across much of the east coast, markets reflected a move beyond the confidence and climate-impacted 2023. The market, however, did not remain in recovery, and instead fell more dramatically than the previous year. Producer sentiment in May reached +4, remaining 22 points below the previous year. This initial volatility impacted producer confidence in the market as well as trading decisions. Cautiousness remained through the year as prices lifted in the autumn market and continued as prices surpassed the 2023 market.

Duality of conditions

As the year continued, quality had the largest impact on price. This reflects a market before recent history, where liquidation and rebuild have driven supply and demand influences. The Australian flock was sitting at its largest in over a decade. Strong supply, partnered with solid international and domestic demand, led to record export volumes. Growth in both established and emerging markets shows that as the top exporter of sheepmeat, Australia has been able to keep up with our improving production.

Strong export demand has maintained competition in the domestic livestock market. This demand has caused market protection across the country as conditions have varied dramatically.

Regions across SA, Victoria, and NSW have experienced extremely tough conditions. Faced with a positive summer season, many producers started the year well. However, conditions dried up fast and hard, placing producers in a position of possibly being overstocked and relying on feed. Alternately, central and northern NSW and sheep pastoral zones generally experienced positive conditions, creating an environment that supported quality and promoted trading. This has led to a very strong year-end as finished lamb prices have remained firm much later than the seasonal norm.

WA continued to operate differently from eastern states without the support of close markets. The state began the year on a low base as dry conditions impacted joining and selling decisions. Turn-off and individual destocking led to a surplus of stock.

There were two main outcomes:

- Prices did not see the same recovery as the eastern market.

- For a period, more animals were turned off than could be absorbed by domestic processors.

This price and stock availability caused a significant movement of stock out of the state, with commentary noting WA animals were travelling even beyond neighbouring SA.

Production

Production of lamb and mutton has skyrocketed thanks to supply and a growth in processor capacity. Looking into weekly slaughter, initially, 2024 followed regular seasonal trends; however, focusing on the tail end of this year, there has been a clear new focus for processors.

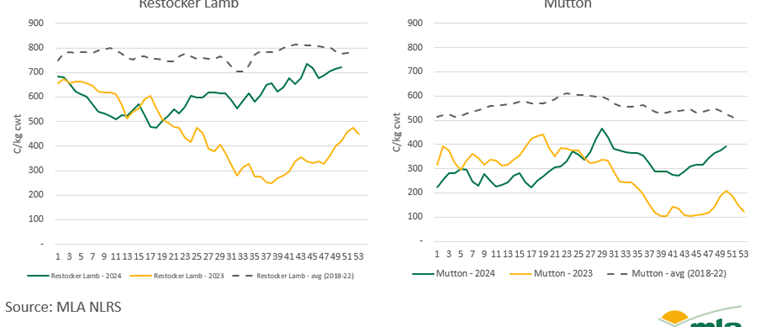

Mutton volumes have lifted dramatically across the country, indicating strength in our export market demand but also an indication of producer decision making. Across WA, the proportion of mutton over lamb is relatively high, showing that producers may be eating into their breeding flock. On the east coast, all states have lifted their production mutton, especially NSW, which just last week processed more than 50% of mutton on lamb, which hasn’t been done since 2007.

Producers are becoming more efficient in production and are able to produce more lambs from less due to genetic, fertility and breed investments. With the reduction of wool production, dry conditions, a large ewe flock, and generally firm mutton prices, decisions have been made around the retention of older stock.

The processing sector’s ability to keep up with the sheep supply is growing. Finishing off with some numbers, based on the year-to-date National Livestock Reporting Service (NLRS) slaughter volumes, combined sheep and lamb slaughter – adjusted up to account for an approximate 20% coverage gap of the NLRS – we have processed more than 37 million sheep and lambs in 2024, with three weeks to go. Australia has not surpassed 35 million in a total calendar year before, enforcing how capable the sector is to absorb a new normal of production.

Looking ahead to 2025

The past 12 months have demonstrated the ability of the sheep sector to recover. An elevated flock, strong supply of stock, and even stronger supplies of sheepmeat, have been absorbed into the domestic and international production systems. Australia is operating in an elevated state which is likely to remain into 2025. Without predicting any extreme climatic conditions (wet or dry), we are likely to continue to produce elevated levels of sheep and lamb.

Three things to keep an eye on into 2025:

- growing international markets, including the emerging UK and India FTA opportunities

- the United States protein situation, which will impact more than just cattle and beef

- breed dynamics – the growth of shedding sheep and the move away from Merinos and wool – how will this impact sheepmeat production moving forward?

Attribute to: Erin Lukey, MLA Senior Market Information Analyst