Kriya Payments

Buy now, pay on your terms for Meatex customers.

Get more flexibility and more time to pay.

Using Kriya Payments

You can pay later with more flexibility. Choose Kriya Payments to:

– Pay in 30 days

– Pay in 60 days

It’s quick, simple and free to use! Kriya Payments is a new way to boost your cash flow so you can pay for the goods your business needs to grow.

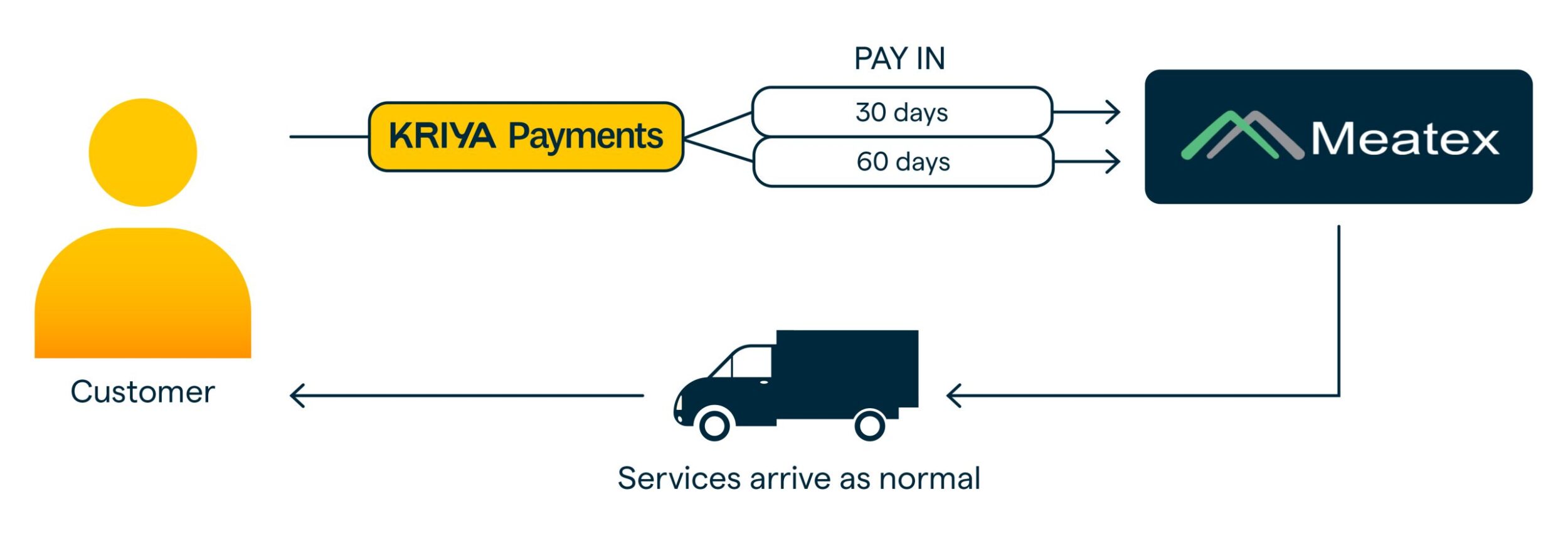

How it works:

- Choose the goods you need on the Meatex website as normal.

- When you get to checkout choose to pay with Kriya Payments in 30 days or 60 days.

- Leave the rest to us! Once we’ve confirmed the amount and your preferred payment option we pay Meatex upfront and you pay us back directly.

What will it cost?

It’s completely free for you to use – we won’t charge you a penny!

FAQs

Why is Meatex offering Kriya Payments?

Meatex is partnering with the best finance providers to give you more flexible credit options when paying for their goods, and more time to pay. Kriya Payments is an innovative way to help you pay later.

How does Kriya Payments work?

When you use Kriya Payments at checkout you won’t have to pay for your Meatex goods for 30 or 60 days, at no extra charge. We'll confirm your payment choice with you via email, along with your agreed payment plan and our account details. We'll remind you when it's time to pay and you can organise this via

bank transfer.

Will this affect my credit score?

Before you can start paying later with Kriya Payments, we’ll perform a soft credit search on your business to check if you’re eligible. These kinds of searches have no impact at all on your credit score. If you pass this, Kriya Payments will be activated on your account. The first time you choose to pay with Kriya Payments at checkout, a hard search will be made (this will only happen on the first purchase). The search will appear on your credit report. Multiple hard searches in a short period of time may affect your credit score.

Who is Kriya?

Kriya is a leading embedded finance platform for businesses that has been operating for 11 years. They deliver flexible finance solutions to solve the cash flow issues that get in the way of progress and have processed over £20bn in payments for UK businesses.

What does it cost?

There are no extra fees if you pay with Kriya Payments, as long as you settle your invoice when it’s due (either in 30 or 60 days, depending on the payment option you’ve chosen).

Can I increase my limit?

If you enjoy paying with Kriya Payments but want access to a higher limit then sometimes we’re able to increase it. Making sure you successfully repay invoices on time can increase the likelihood of this. We would need a minimum of either one successful repayment and an Open Banking connection, or three successful repayments to consider any limit increase requests.